Nationally Recognized Personal Injury Attorneys.

Record-Setting Results.

- 200+ Years of Experience

- The Attorney You Want On Your Side

- You Don't Pay Unless We Win!

Free Confidential Consult

Fill out the contact form

Practice Areas

Nursing Home Abuse & Neglect

If you believe that a loved one may be the victim of nursing home abuse, take action and immediately. Our #1 priority is guiding you through this challenging time.

Birth Injury

Our renowned birth injury attorneys are licensed to pursue claims in most U.S. states. We’re here to help ease the financial burden and emotional struggle that comes with tending to your newborn’s preventable harm.

Medical Malpractice

Our medical malpractice attorneys represent clients who have been injured or killed by careless health care providers – hospitals, doctors, nurses, psychiatrists, dentists, chiropractors, podiatrists and more.

Personal Injury

Our Chicago personal injury attorneys share a commitment to helping those harmed by the negligent, careless, or wrongful actions of others.

Car Accidents

Our team of car accident lawyers is determined to hold negligent people responsible for their actions and the harm they caused others. We will never settle a case for anything less than it’s worth.

Truck Accidents

Our truck accident lawyers at Levin & Perconti have a combined experience of over 200 years helping victims recover damages sustained in vehicular and truck accidents.

Nationally Recognized Attorneys Since 1992

Levin & Perconti is a nationally renowned law firm concentrating in all types of serious injury, medical malpractice, birth injury, nursing home abuse, and wrongful death litigation. Our award-winning trial attorneys are committed to protecting and vindicating the rights of people who are seriously injured by the negligence of others. Our firm is located in Chicago, IL but our personal injury attorneys, including our specialized birth injury team, handle lawsuits for clients throughout Illinois and the United States.

Our goal is simple: to achieve the best possible results for each client in every case we handle. It is a goal we have been consistently successful in meeting. Since 1992, our personal injury team has recovered more than a billion dollars in verdicts and settlements for our clients, including a number of record results.

If you have questions about a potential personal injury or medical malpractice lawsuit, we can help. Call us at 312-332-2872 for a free consultation. You can also complete our online contact form.

All consultations are free, and if we accept your case, you will pay no fees unless or until we successfully resolve your case.

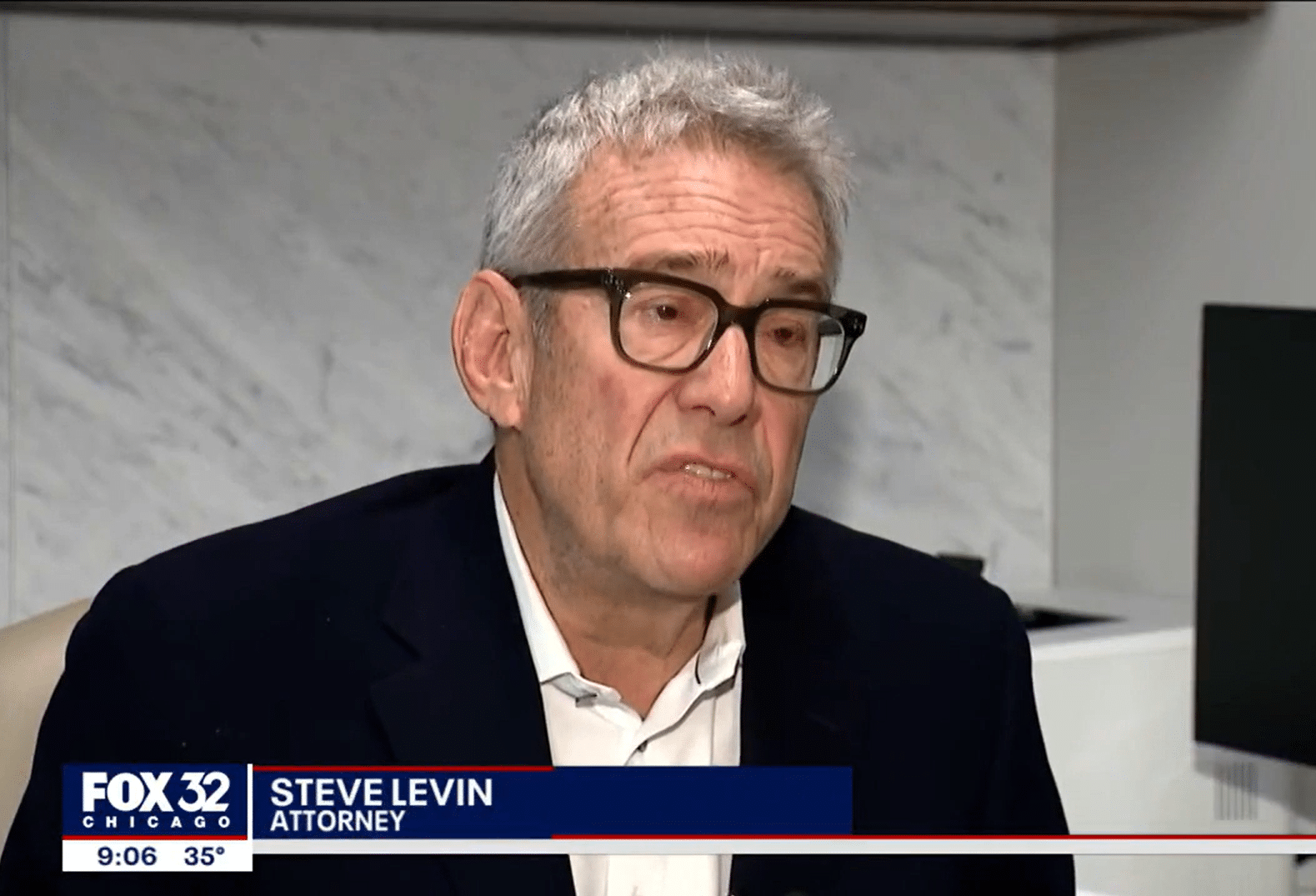

Our Attorneys

Our attorneys are proud to offer clients over 200 years of combined litigation experience and our record of success has earned us widespread acclaim. Year after year, Steve Levin and John Perconti have been honored by fellow lawyers as two of the top personal injury attorneys in Illinois. Our lawyers are well-respected by adversaries who know that we will never settle a case for less than full compensation, and many of the best lawyers in the country feel confident recommending our services to their own clients.